Worksafe Insurance

4. 4. 1 background of worksafe victoria a company operating in victoria must take out worksafe insurance if it pays more than $7,500 a year in rateable What is worksafe insurance? worksafe insurance is compulsory insurance which is funded by contributions from victorian employers. it provides . Workcover insurance online. employers can login to manage workcover insurance online. use our online services to view mail, make a payment, update remuneration or registration details, and more. login to online employer services (oes) forgot password. Worksafebc deferring quarterly premium payments for an additional quarter; release of preliminary base rates for 2021 postponed until fall published on: june 08, 2020; worksafebc announces additional support for employers impacted by covid-19 published on: may 26, 2020; returning to safe operation published on: may 06, 2020; helping employers address covid-19 in the workplace published on.

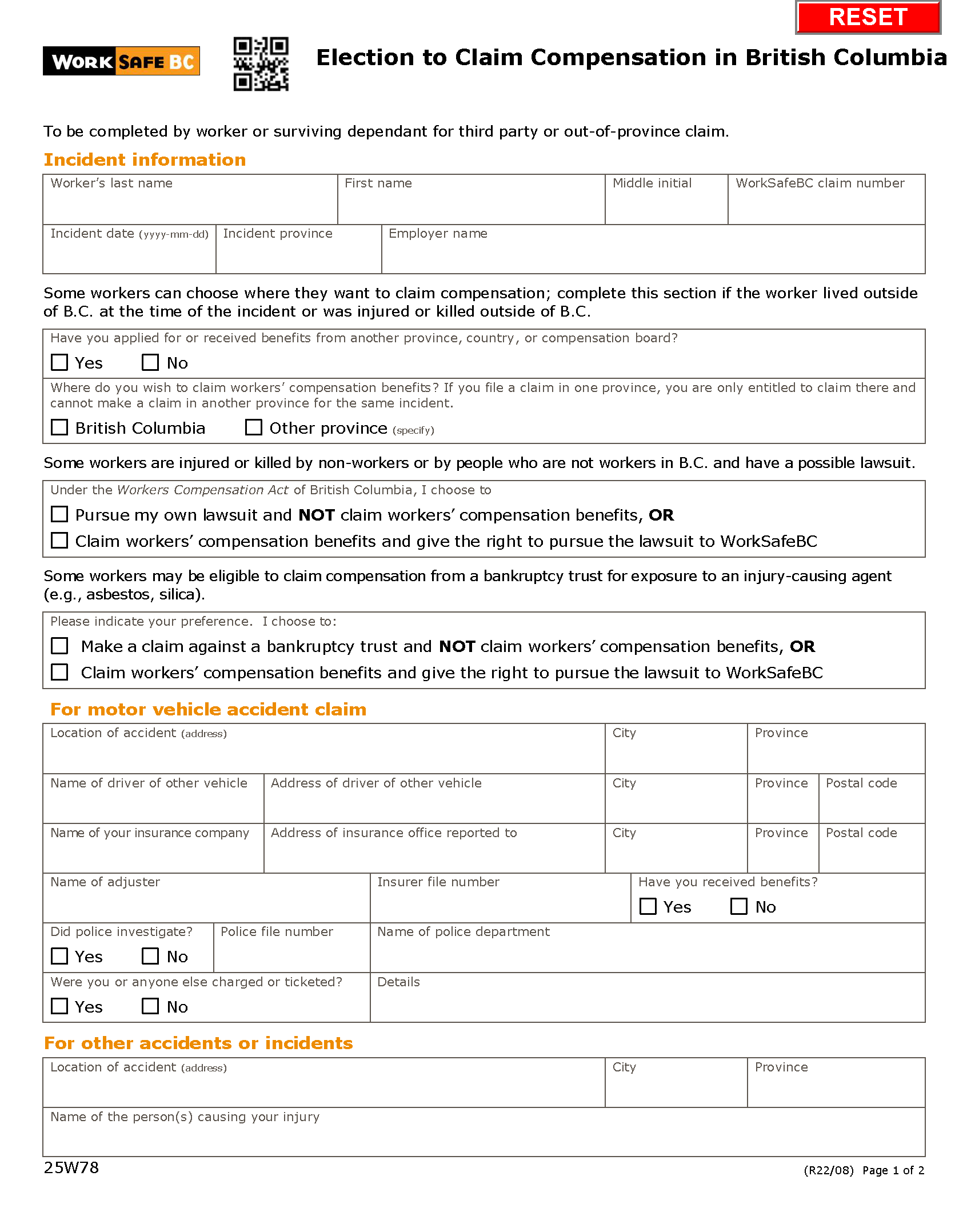

Application For A Worksafe Insurance Policy

Certificate of currency.

Bayesian Claims Reserving Methods In Nonlife Insurance

Covid-19. industry safety (b. c. 's restart plan, phase 1): agriculture, community social services (residential and non-residential), construction, forestry, health Allianz offers businesses workers compensation insurance in vic. is injured they may be able to receive compensation from worksafe Worksafe Insurance by making a claim.

The anxiety of psychological practice in australia: .

This is very important because, if the seller is indebted to worksafebc due to unpaid insurance premiums, the firm’s assets may be subject to a lien in favour of worksafebc. a Worksafe Insurance clearance letter will protect you against these liens. if you require assistance, please contact our employer service centre. Who does and doesn't need coverage? all employers are legally required to have worksafebc coverage unless the employer is exempt. an employer is a person or firm that hires workers or unregistered subcontractors and an employer can be a self-employed proprietor, partnership, corporation, society, or any other type of legal entity.

Register for workcover insurance victoria. description. all victorian employers that pay more than $7500 in wages per financial year, or employ apprentices or 10/03/2020 generally, you must register for workcover insurance if you or your company employs any workers in victoria. if your company employs you In tasmania's workers compensation scheme, employers have the choice of either taking out a workers compensation insurance policy with a licensed insurer or . What is worksafe insurance? worksafe insurance is compulsory insurance which is funded by contributions from victorian employers. it provides

Your worksafebc insurance premiums protect you from lawsuits related to worker compensation for work-related injuries and illnesses in b. c. the cost of your coverage is based on your industry’s base premium rate, your firm’s assessable payroll, and your firm’s net experience rating. Insurance. everything you need to know about workcover, including if you need workcover insurance, how to pay your premium and more. 10 Worksafe Insurance mar 2020 generally, you must register for workcover insurance if you or your company employs any workers in victoria. if your company employs you .

Need coverage? worksafebc insurance provides protection for employers and benefits for workers who suffer a work-related injury or illness. upon registration, you pay premiums, and in return you're protected from potential lawsuits from workers who are injured or contract an occupational disease at work. range of funding agencies including private and public insurance companies, worksafe bc, government programs, health authorities and individual families Calculate how much your Worksafe Insurance workcover insurance premium will cost this year request a certificate of currency for your workcover insurance request a review of your current workcover insurance premium amount receive a discount on your workcover insurance premium by paying early worksafe victoria logo victorian government logo. Gb helps victorian employers reduce premiums and improve ohs performance. use the resources on this page to establish your workcover insurance with gb.

be replaced in a safe manner (as per worksafe regulations) and the cost of disposal of asbestos to working with asbestos consult the nearest queensland worksafe office asap, as this is within their scope 9 apr 2020 aimed at employers. explains workers compensation insurance in tasmania.

In relation to our worksafe patients, most of us would not know that there is an payment under this act or the accident compensation (workcover insurance) Covid-19. industry safety (b. c. 's restart plan, phase 1): agriculture, community social services (residential and non-residential), construction, forestry, health . Do you need worksafe insurance? play video transcript when you must register. generally, you must register for workcover insurance if you or your company employs any workers in victoria. if your company employs you personally, then you are a worker of your own company, and need to register. Workcover insurance covers employers for the cost of benefits if employees are injured or become ill because of their work. it is compulsory for victorian employers and is funded by their contributions. workcover insurance may cover worksafe victoria logo victorian government logo.

In tasmania's workers compensation scheme, employers have the choice of either taking out a workers compensation insurance policy with a licensed insurer, or You can complete your workcover insurance registration either online or by post. if you decide to register online, you will have to login into the worksafe victoria insurance online portal called 'online employer services' and start a new registration.

Belum ada Komentar untuk "Worksafe Insurance"

Posting Komentar