Margin Trading In Forex What Is

Marginin Forextrading Margin Level Vs Margin Call

What Is Forex Margin Margin Calculator Forexfreshmen

Forex trading in the spot market has always been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on. in the past, the futures market. What does “free margin” mean? margin can be classified as either “used” or “free”. used margin, which is just the aggregate of all the required margin from all open positions, was discussed in a previous lesson.. free margin is the difference between equity and used margin.. free margin refers to the equity in a trader’s account that is not tied up in margin for current open. What does “free margin” mean? margin can be classified as either “used” or “free”. used margin, which is just the aggregate of all the required margin from all open positions, was discussed in a previous lesson.. free margin is the difference between equity and used margin.. free margin refers to the equity in a trader’s account that is not tied up in margin for current open.

In the forex world, brokers allow trading of foreign currencies to be done on margin. margin is basically an act of extending credit for the purposes of trading. for example, if you are trading on a 50 to 1 margin, then for every $1 in your account, you are able to trade $50 in a trade. See more videos for what is margin in forex trading. Margin is one of the most important concepts of forex trading. however, a lot of people don't understand its significance, or simply misunderstand the term. a forex margin is basically a good faith deposit that is needed to maintain open positions. a margin is not a fee or a transaction cost, but.

Margin Call What Is It The Balance

Cfds Forex Online Trading Cmc Markets

Using margin in forex trading is a new concept for many traders, and one that is often misunderstood. to put simply, margin is the minimum amount of money required to place a leveraged trade and. Margin trading in the forex market is the process of making a good faith deposit with a broker in order to open and maintain positions in one or more currencies. margin is not a cost or a fee, but. Margin call, a term often met with dread, carries with it some heavy-duty meaning in forex trading.. a margin call occurs when a trading account no longer has any free margin. it is a request from the broker to bring margin deposits up to the initial margin level, also known as deposit margin, to keep existing positions open. trading on margin offers a variety of benefits, as well as some. Margin is the amount of money that a trader needs to put forward in order to open a trade. when trading forex on margin, you only need to pay a percentage of the full value of the position to open a trade.. margin is one of the most important concepts to understand when it comes to leveraged forex trading. margin is not a transaction cost.

What is margin in forex? fx margin cmc markets.

Margin call: what is it? the balance.

What Is A Margin Call In Forex Trading Fp Markets

cfd trading cfd holding costs learn forex trading what is forex ? forex trading examples forex technical indicators using leverage in forex trading benefits of forex trading our platform pricing cfd margin trades trading library the artful trader podcast special Final words on margin in forex trading. trading on margin is extremely popular among retail forex traders. it allows you to open a much larger position than your initial trading account would otherwise allow, by allocating only a small portion of your trading account as the margin, or collateral for the trade. Margin’s in forex is a necessary element that you are almost surely going to come across in your trading career. this is especially true as you become more experienced and need to make bigger trades that are beyond your current equity account. What is free margin in forex trading? in its simplest definition, free margin is the money in a trading account that is available for trading. to calculate free margin, you must subtract the margin of your open positions from your equity (i. e. your balance plus or minus any profit/loss from open positions).

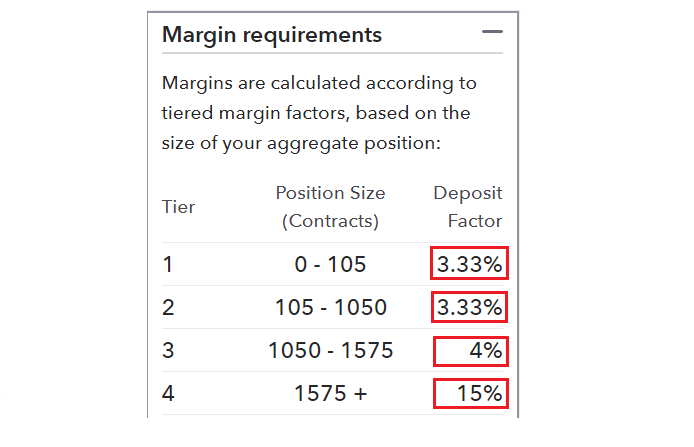

What is margin trading in forex what is margin? when tradingforex, you are only required to put up a small amount of capital to open and maintain a new position.. this capital is known as the margin.. for example, if you want to buy $100,000 worth of usd/jpy, you don’t need to put up the full amount, you only need to put up a portion, like $3,000. the actual amount depends on your forex broker or cfd provider. Margintrading in the forex market is the process of making a good faith deposit with a broker in order to open and maintain positions in one or more currencies. margin is not a cost or a fee, but.

A forex margin account is in a general sense the same as a qualities margin account the cash related master is taking a fleeting advancement from the broker. the advance is proportionate to the measure of leverage the analyst is going up against. In the forex market, there is a term equity that considered as an account margin. a margin account allows you to trade with debt. traders can invest a lot of money in trading via a margin account.

Alpari is a member of the financial commission, an international organization engaged in the resolution of disputes within the financial services industry in the forex market. risk disclaimer: before trading, you should ensure that you've undergone sufficient preparation and fully understand the risks involved in margin trading. Margin and leverage are among the most important concepts to understand when trading forex. these essential tools allow forex traders to control trading positions that are substantially greater in size than would be the case without the use of these tools. at the most fundamental level, margin is the amount of money in a trader's account that is required as a deposit in order to open and.

All day trading markets have margin requirements that set the minimum amount of cash or equity that needs to be maintained in a trading account in order to trade that market. minimum margin requirements are set by exchanges or regulatory bodies, but brokers may have margin requirements over and above the required minimum. What is margin? when trading forex, you are only required to put up a small amount of capital to open and maintain a new position.. this capital is margin trading in forex what is known as the margin.. for example, if you want to buy $100,000 worth of usd/jpy, you don’t need to put up the full amount, you only need to put up a portion, like $3,000. the actual amount depends on your forex broker or cfd provider.

In forextrading, leverage is related to the forexmargin rate which tells a trader what percentage of the total trade value is required to enter the trade. so, if the forex margin is 3. 3%, then the leverage available margin trading in forex what is from the broker is 30:1. if the forex margin is 5%, then the leverage available from the broker is 20:1. What is margin in forex trading? margin is the amount of funds that the broker requires from the trader in order to cover any potential losses, since a trader is allowed to use more capital than the amount he or she initially deposited. Forextrading in the spot market has always been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on. in the past, the futures market.

Belum ada Komentar untuk "Margin Trading In Forex What Is"

Posting Komentar